Report and surveys

2016 - Mobile consume study ( Vibes).

Mobile has been long pointed to as the next great communication channel for marketers, and for good reason. A vast majority of today’s consumers keep their mobile devices within arm’s reach at all times. This positions the smartphone as the consumer’s most trusted and important device, all while turning it into the marketer’s most direct and reliable engagement vehicle.

Smartphone adoption hit new record highs – as nearly two-thirds of Americans

now own device, according to Pew Research1. Coinciding with that, a majority of

our retail and brand clients witnessed their own customer bases make the shift to

mobile-first.

We’ve received a variety of questions from clients and marketers just like you.

Many seeking to better understand consumer mobile preferences, and arrive to

a point-of-view on how their own customer bases use mobile to research, shop,

subscribe and interact with the world around them.

Our 2016 Mobile Consumer Study was designed to do just that. This report features

the latest mobile consumer preference data, along with insights into the ways

brands and marketers currently use mobile to engage customers. The goal of this

report is to help you not only learn how your customers are using mobile – but also

understand how they want to use mobile as well.

Whether you’re new to mobile, or a seasoned practitioner, we encourage you to use

this report and its data to:

• Grow mobile subject matter expertise

• Better understand customer mobile habits and preferences

• Inform your mobile strategies based on consumer-preferred tactics and offerings

2015 - Luxury Goods Worldwide Market Study Fall-Winter 2015: A time to act—how luxury brands can rebuild to win ?

A report by

Currency fluctuations and globe-trotters boost the personal luxury goods market, but real growth slows

The 14th edition of the Bain Luxury Study, published by Bain & Company for Fondazione Altagamma, the trade association of Italian luxury-goods manufacturers, analyzed recent developments in the global luxury- goods industry.

The overall luxury industry tracked by Bain & Company comprises 10 segments, led by luxury cars, luxury hospitality and personal luxury goods, which together account for 80% of the total market. The industry surpassed €1 trillion in retail sales value in 2015 and delivered healthy growth of 5% year over year (at constant exchange rates), driven primarily by luxury cars (8%), luxury hospitality (7%) and fine arts (6%).

Aided by global currency fluctuations and continued purchases by “borderless consumers,” the personal luxury goods market—the “core of the core” of luxury and the focus of the Bain Luxury Study—ballooned to more than €250 billion in 2015. That represents 13% growth over 2014 at current exchange rates, while real growth (at constant exchange rates) has eased to only 1% to 2%. The slowdown confirms a shift to a “new normal” of lower sales growth in the personal luxury goods market, which we highlighted in previous analyses. The challenge for luxury brands in this environment is to successfully navigate market volatility driven by currency swings and fluctuating tourist flows.

Currency swings affect regional performance

Boosted by a strong US dollar, the Americas emerged as the biggest global region for personal luxury goods purchases. However, in real terms, the US market did not deliver. The “super-dollar” was too expensive for many global tourists and, although local consumption grew, it was barely sufficient to offset the decline in tourism revenue.

Europe posted sound growth, primarily fueled by Chinese and US tourists attracted by a weak euro. The old continent has become “the world’s largest in-season outlet.” Our analysis of European tax-free shopping data, conducted in partnership with Global Blue, showed that Chinese tax-free purchases in Europe increased by 64% while tax-free purchases by American tourists in Europe grew by 67%, primarily in the high end of the luxury spectrum. Meanwhile, Russian and Japanese travelers cut their tax-free spending in Europe by 37% and 16%, respectively.

Across Asia, performance varied widely:

Chinese consumers play a primary role in the growth of luxury spending worldwide. They account for the largest portion of global purchases (31%), followed by Americans (24%) and Europeans (18%). Chinese shoppers continue to spend far more abroad than in Mainland China, which accounts for only 20% of their global purchases. However, the depreciation of the euro boosted the country to the global luxury podium; it is now the third-biggest market in the world, after the US and Japan. The most popular travel destinations for Chinese luxury shoppers shift—typically to Europe, South Korea or Japan—in response to currency fluctuations, which create temporary favorable price gaps.

Wholesale still dominates, but company-owned retail and e-commerce are growing faster

Wholesale is still the dominant selling channel within the personal luxury goods market, capturing 66% of the total market. However, retail continues to gain share, driven by network expansion (600 new directly operated stores opened globally in 2015, a decline from the 750 opened in 2014) and growth in same-store sales (13% at current exchange rates). The wholesale channel’s slower performance stems from three factors: the ongoing “retailization” of luxury (converting franchised locations into company-owned stores or joint ventures); the lackluster performance of US department stores across product categories (particularly in leather goods); and the decreasing sales of Asian watch retailers, which are coping with excessive stock and a reduction in the overall store network.

E-commerce grew to a 7% market share in 2015, nearly doubling its penetration since 2012. Specialized e-commerce players are outperforming the market globally, with Chinese e-tailers progressively extending their geographic reach and gaining share on a global basis. The e-commerce sites of European and American retailers (such as department stores) continue to grow, a response to customers’ demands for an omnichannel experience. Luxury brands are losing share online overall, with highly variable performance: The largest brands with established direct online and omnichannel platforms are outperforming but the majority of brands still lag, especially European brands.

Luxury globe-trotters have also fueled the performance of airport retail, which posted a 29% growth rate in current exchange rates (18% in constant exchange rates) and now accounts for 6% of the global luxury market.

With the growing middle class in markets such as China seeking good quality and good value, and consumers in mature markets looking for bargains, the off-price channel has more than doubled to nearly €26 billion. Markdowns are also increasing in prevalence across more than 35% of the luxury market.

Accessories remain the leading category

Among specific categories of personal luxury goods, accessories remained the leader, capturing 30% of the market and growing by 3% in 2015 (at constant exchange rates). That was faster than the next two largest categories, apparel (which grew 2% at constant exchange rates) and hard luxury (which contracted by 3%). Within accessories, high-end shoes (4%) continued to grow faster than leather goods overall (2%). Jewelry was the star category within hard luxury, growing at 6% in constant exchange rates, while watches were strongly hit by the channel overstocking in Asia and contracted by 6% in constant exchange rates.

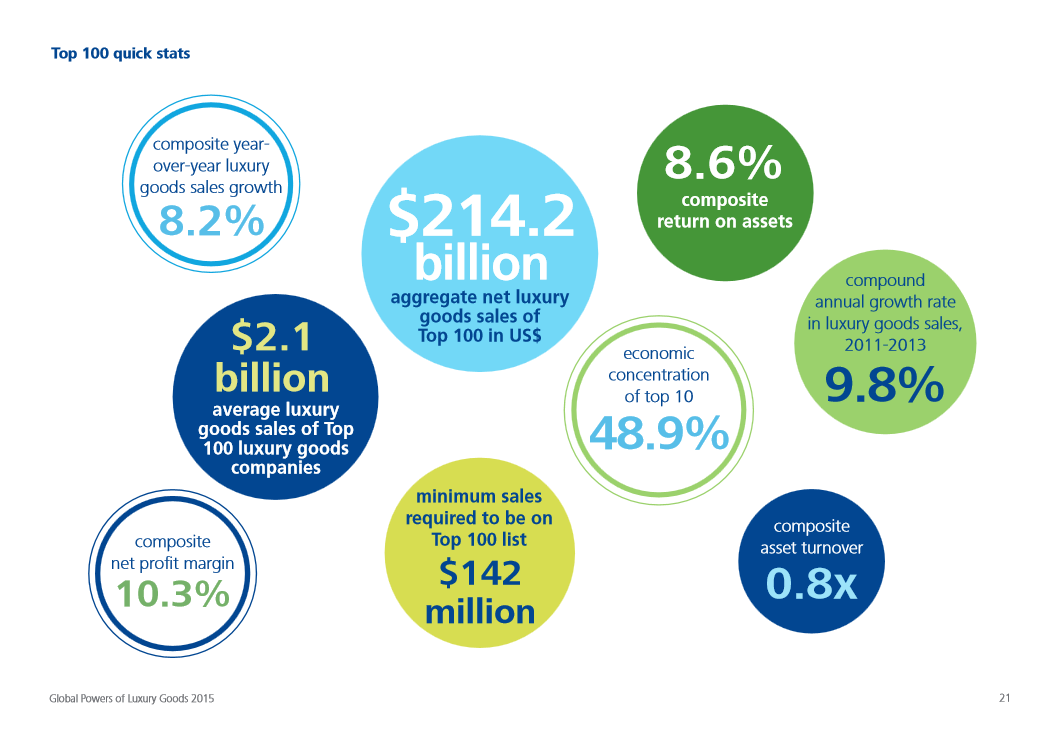

Global Powers of Luxury Goods 2015 Engaging the future luxury consumer

present the 2nd annual Global Powers of Luxury Goods.

This report identifies the 100 largest luxury goods companies around the world based on publicly available data for the fiscal year 2013 (encompassing companies’ fiscal years ended through June 2014).

The report also provides an outlook on the global economy; an analysis of market capitalization in the luxury goods industry; a look at merger & acquisition activity in the industry; and a discussion on engaging the future luxury consumer

The key learnings of this survey are:

-

The economic climate for luxury goods companies is on balance, positive, but there are risks and problems nonetheless. On the positive side, the economies of the U.S., Europe, and Japan all appear to be on the rebound. Asset prices, including property prices, have done well, thus boosting the purchasing power of upscale consumers. On the negative side, economic growth in three of the four BRIC economies has either stalled or decelerated, the exception being India. Moreover, currency market volatility has thrown a monkey wrench into the best laid plans of many companies. Among the risks going forward are the possibility of a rise in energy prices, a drop in asset prices, and potential geopolitical shocks in such places as the Middle East and the South China Sea. Overall, however, luxury goods companies should be pleased that, after many years of stagnant growth, the global economy is mostly on a positive path.

-

The relationship between digital and luxury can no longer be ignored. Technology will continue to influence the entire value chain within the sector.

-

Technology as a competitive advantage: Navigating the uncertainty of the “wearable dimension.

-

The global make up of luxury demand is changing: Being able to identify the right channel for marketing, understand purchasing motivations of luxury consumers, and address the differences in benefits between shopping in-store vs. online will be a key focus for luxury brands going forward. These factors are strongly aligned with the increasing importance of digital within the luxury space

-

The traditional approach to corporate social responsibility has evolved; there is now an expectation that societal and environmental investments should positively reinforce the corporate brand strategy. This concept of shared value will continue to be of utmost importance in 2015 and the luxury industry has a unique role to play in its development. The luxury space can create powerful experiences that will help to positively influence societies and cultures by nurturing talent, celebrating history and culture, and supporting brand ethos though charitable change—and in doing so support long-term growth of the luxury value chain.

Download here the full report.

2014 - The swis watch industry (By Deloitte).

The Deloitte Swiss Watch Industry - Study 2014 - Changing times

Foreword

"The study highlights the views of watch company executives on the key challenges and opportunities facing the Swiss watch industry.

Growth has been one of the defining features of the watch industry. But while many remain optimistic for growth over the next 12 months, weakening foreign demand is perceived as a significant risk.

While the outlook is not as optimistic as it has been in the last 2 years, notably for China, new opportunities are expected in developing markets such as India and Indonesia, with European and US markets also strengthening. Product innovation and high end watches continue to be a key focus.

The buzz around smartwatches has been building momentum with new developments in functionality and content continually being introduced, each with the potential to be ‘the next big thing’.

The rapid pace of adoption of social media as a primary communication forum within the watch sector has been an interesting evolution in this industry".

Summary

- Industry outlook and demand

- Overall outlook remains positive

- Europe is back

- Swiss sales to foreign tourists to continue growing

- High-end segment continues to drive expectations

- Mechanical watches win export share

- Challenges and risks

- Overall risk outlook

- Availability of qualified labour remains a challenge

- Availability of parts and movements challenging as well

- Business strategies

- New product trends

- Smartwatches: Still a simple buzzword or a new electronic revolution?

- Vertical integration to continue, while horizontal integration is becoming more important

- Marketing and distribution – Sales channels

- Marketing – Traditional and digital

2014 - Luxury goods report (By Deloitte).

Global Powers of Luxury Goods 2014 : In the hands of the consumer

Deloitte Report-2014

Summary:

- Global Powers of Luxury Goods

- Global economic outlook

- Global trends affecting the luxury industry

- Top 75 highlights

- Retailing activity

- M&A activity

- Q ratio analysis

2012 - Luxury sector report (By PWc).

An Overview of the 2012 Luxury Market :

Summary:

- Worldwide Luxury Goods Market trends by geography 2007-2014E

- Worldwide Luxury Goods Market trends by product 2007-2014E

- Breakdown luxury market value by category, 2010-2011

- Absolute/Aspirational(apparel&accessories) market value 2007-2011

- Chinese market

- Online Sales worldwide

- Asia

- Retail

- Consumers purchase motivations

- Main strategies ?